- This pays for dealing with injuries to you and also your travelers without respect to mistake. Your automobile insurance policy deductible is the quantity of cash you have to pay out-of-pocket prior to your insurance policy compensates you.

You have a Subaru Outback that has Crash Coverage with a $1,000 deductible. You back side an additional vehicle driver, and your Subaru is damaged. You take it to the body shop as well as the complete cost to repair all the damages is $6,500. In this scenario, you would pay the body shop $1,000. Exactly how do I acquire vehicle insurance? When buying insurance coverage, the Division of Insurance policy advises that you seek the advice of a professional insurance policy expert. There are 3 kinds of professionals that commonly market insurance coverage: Independent agents: can offer insurance coverage from numerous unaffiliated insurance firms. Special agents: can just market insurance policy from the company or team of business with which they are associated.

Despite what sort of professional you choose to make use of, it is essential to confirm that they are licensed to perform organization in the State of Nevada. You can inspect the license of an insurance specialist or company right here. Keep in mind Always validate that an insurer or representative are licensed before giving them individual details or payment.

These aspects consist of, however are not restricted to: Driving record Insurance claims history Where you live Gender and also age Marriage Status Make as well as version of your automobile Credit scores Nevada has one of one of the most competitive and also healthy vehicle insurance markets in the nation. Purchasing insurance may allow Look at this website you to accomplish competitive pricing.

5 Easy Facts About Liability Car Insurance - What Does It Cover? Described

To learn more about using your credit report details by insurance policy firms review our Regularly Asked Questions Concerning Credit-Based Insurance Ratings.

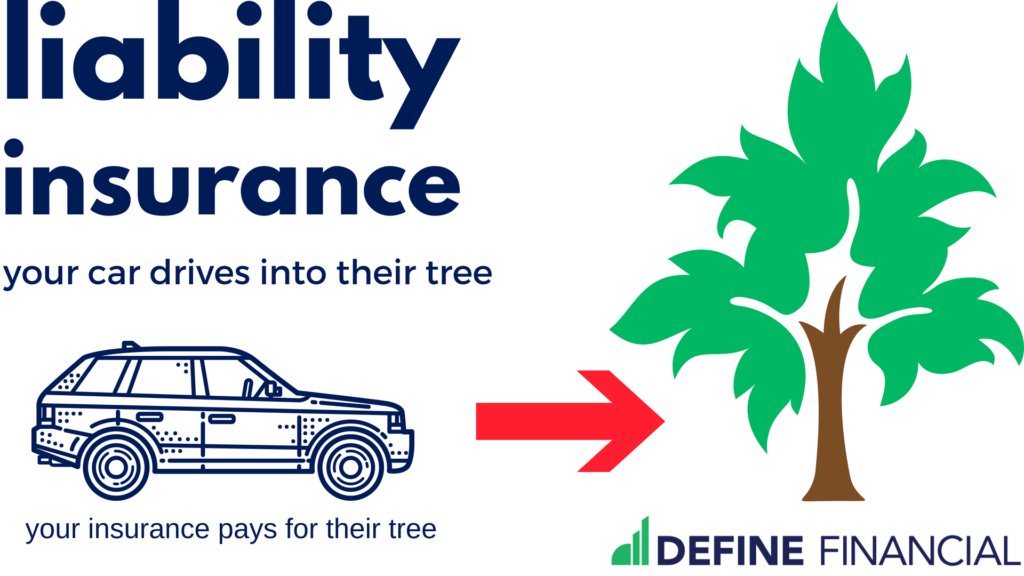

Home damage responsibility insurance coverage pays for damage you cause to the building of others. This consists of problems to automobiles and other building such as walls, fencings as well as devices. Accident protection spends for physical damages to your car as the outcome of your automobile ramming a things. This coverage is not needed by law, however may be needed by a loan provider or leasing business.

Liability insurance coverage is just one of one of the most common and also important kinds of auto insurance coverage. It can potentially help you avoid a financial disaster if you're found to be responsible for creating an accident. So, what does responsibility insurance cover? What Is Automobile Obligation Insurance? Responsibility insurance coverage is auto insurance coverage that's obligatory in a lot of states.

To obtain this sort of coverage, you need to take into consideration purchasing clinical repayment insurance coverage. You can inquire from your insurance policy representative if you would like to know more concerning car responsibility insurance coverage or the minimal car insurance needs in your state. What Is the Protection Limit for Auto Responsibility Insurance Coverage? Vehicle liability insurance coverage have different physical injury and building damage insurance coverage limitations.

The 8-Minute Rule for How Much Car Insurance Do You Need? - Edmunds

The first 2 numbers are the insurance coverage limits for physical injury. The first number refers to the maximum amount your automobile insurance provider will spend for each hurt person in the accident, while the 2nd number is the maximum coverage for the entire crash. The 3rd number is the coverage restriction for home damages.

How Much Obligation Insurance Policy Do You Required? As long as you're carrying the minimum quantity of vehicle liability insurance needed in your state, you aren't doing anything wrong.